Smart investors only take risks when they expect to get paid for it. That extra payment is called the risk premium, and it’s always positive when you’re looking ahead (though it bounces around).

In my last post, I explained why capital markets aren’t like casinos, as they actually offer positive expected returns, and where investment returns come from. Now let’s dig into the theory behind risk premia and the different types you’ll encounter. This will set us up to talk about building portfolios later.

What Are Risk Premia?

The risk premium tells you how much extra return you can expect over the long haul from owning a particular investment compared to the safest possible option (usually short-term government bonds). The main ones are term premium, credit premium, and equity premium. There are also premia tied to market quirks, like value and momentum.

Term Premium

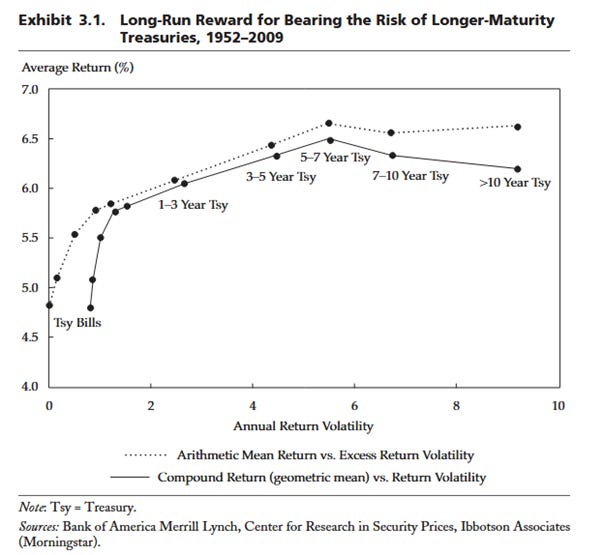

When you buy long-term government bonds instead of short-term ones, you’re taking on more risk because nobody really knows what the economy will look like 10 or 20 years from now. So the term premium is the difference in interest rates between short-term and long-term bonds. On average, this has been around 0.5% point per year.

Here’s the weird part: bonds longer than five years don’t actually give you better returns than five-year bonds. You’re taking extra risk without getting paid for it.

Credit Risk Premium: When Companies Borrow Money

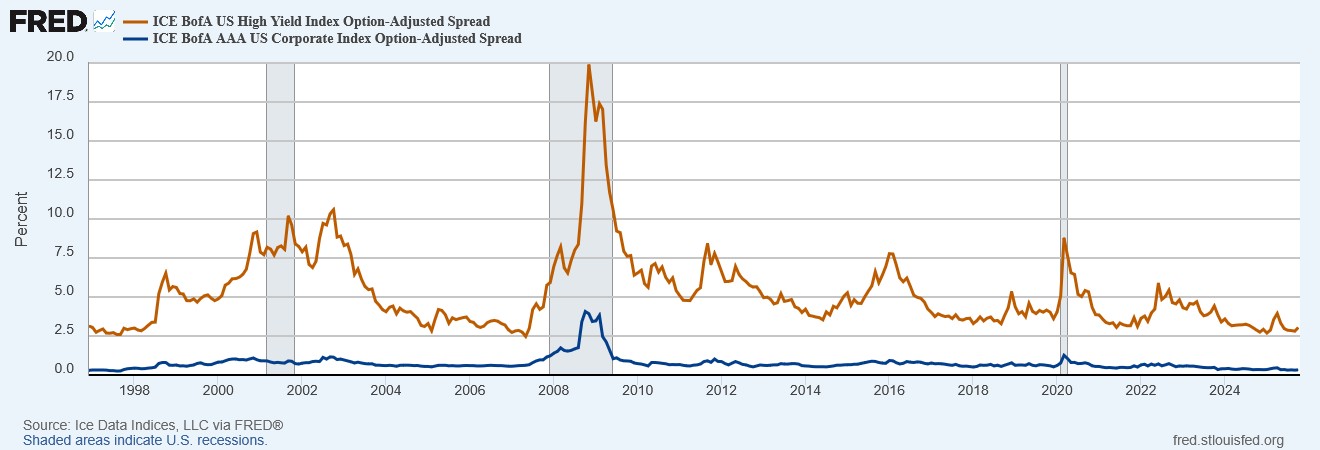

Unlike governments, companies can’t just print money when they’re in trouble. That means corporate bonds always include some risk that the company won’t be able to pay you back. Investors only accept this risk if they’re getting paid extra for it. How much extra depends on the company’s financial health: rock-solid investment-grade companies pay less, while shakier firms have to offer more.

Credit rating agencies split bonds into investment-grade and non-investment-grade (also called high-yield or, less politely, junk bonds). The difference between the two is apparent in both how often they fail to meet their payment obligations and how much premium they pay. Agencies use letters to show riskiness. AAA is the safest, then AA, then A. BBB is the last stop before you leave investment-grade territory. BB is where high-yield begins. Ratings can go all the way down to D, indicating that the bond has already defaulted (fails to make a scheduled payment).

Equity Risk Premium: Why Stocks Beat Bonds

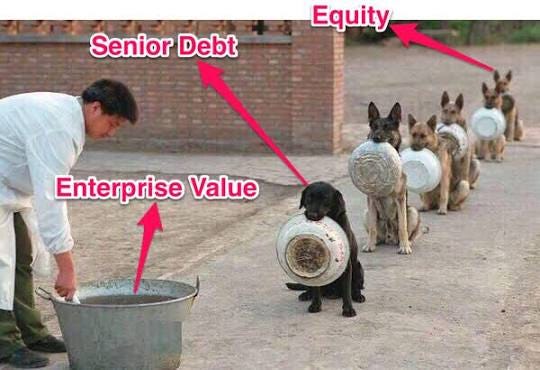

When a company runs into trouble, shareholders are last in line. Senior debt owners receive their interest first, and only then do shareholders see any dividends. If the company tanks or goes bankrupt, shareholders might receive nothing. This extra risk is why stocks tend to beat bonds over the long run—that’s the equity risk premium in action.

Value and Momentum Premia: Market Quirks That Actually Work

The stock market has some interesting quirks, as not all stocks behave as textbooks say they should. Some consistently do better than others. Researchers have found tons of these anomalies, but only two have held up over the long haul: momentum and value.

Momentum refers to stocks that have been doing well lately and tend to keep doing well for a while. This probably comes down to human psychology—nobody wants to miss out on the hot stocks, so everyone keeps piling in.

Value is the opposite idea: cheap stocks tend to beat expensive ones over time. When bad news hits, cheap stocks often drop too much. When good news comes out, expensive stocks usually rise too much. But capitalism has a way of evening things out. Weak companies get better, strong ones stumble, and everyone moves toward average. Eventually, the market corrects itself, and value investors get rewarded.

A quick summary

Risk premia come from four main places:

Term premium: the difference between the return of long-term and short-term bonds

Credit premium: the difference between the return of safe government bonds and corporate bonds

Equity premium: the difference between the returns of stocks and bonds

Market anomalies:

Momentum: everyone wants to join the winners

Value: the underdog rises with time, granting higher returns

Understanding these building blocks will help us explore, how different investors tap into these sources of extra return—and how you can combine them into a portfolio that works for you.

Disclaimer

The views and opinions expressed on this website are for educational and informational purposes only, and should not be considered as investment advice. The author may hold positions in the stocks mentioned on this website. The author of this website is not a licensed stockbroker or financial advisor. Nothing contained herein should be construed as a recommendation to buy, hold, or sell any securities or financial products. Always seek the advice of a financial advisor and do your own independent research before making any trade or investment decisions.

We do not guarantee the accuracy or completeness of any information on this website. Such information is provided “as is” without warranty or condition of any kind, either express or implied. Past performance may not be indicative of future results. This website could include inaccuracies or typographical errors.

We are not liable or responsible for any damages incurred whatsoever from actions taken from information provided on this website, including financial losses. Since all readers who access any information on this website are doing so voluntarily and of their own accord, any outcome of such access is understood to be their sole responsibility. In no event shall we be liable to any person for any decision made or action taken in reliance upon the information provided herein.