Most investors overcomplicate their portfolios, chasing returns that don’t materialise and taking risks that don’t pay off.

A few simple principles – broad diversification, compensated risk, and low costs – will deliver better results than most hot stock tips or active fund managers.

The Two-Component Framework

Portfolio construction comes down to balancing two fundamental components: risky assets and risk-free assets. According to financial theory, these two components are the same for everyone if one does not have special insight into the expected returns of individual asset classes or securities. Your risk-taking ability only influences the weights of these two parts.

Risky assets provide growth potential and higher expected returns. Stocks and corporate bonds are the primary examples. They offer appreciation and income, but with significant volatility.

Risk-free assets provide stability and capital preservation. Government bonds with a maturity that matches your investment horizon fall into this category. While their returns are modest, they serve an essential function in managing portfolio volatility.

Individual risk tolerance varies significantly, but the basic building blocks remain constant. The key decision is determining the appropriate allocation between these two components.

The Risky Portfolio

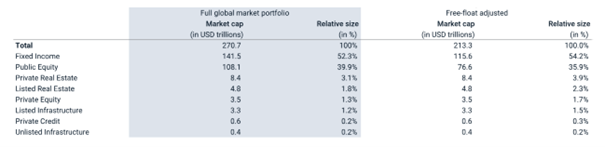

In theory, the risky portion of a portfolio should approximate the global market portfolio—essentially all investable assets worldwide. According to MSCI research, this translates to roughly 60% stocks and 40% bonds.

For the risk-free component, government bonds denominated in your home currency with maturities aligned with your investment horizon provide the most appropriate foundation. This approach eliminates currency risk and ensures funds are available when needed.

The final portfolio combines these two components based on individual risk tolerance. As discussed in my previous post on risk assessment, this is where those evaluation frameworks become practically useful.

Compensated vs. Uncompensated Risk

A critical distinction in portfolio management is between risks that offer compensation and those that don’t.

Long-term bonds present a typical example of uncompensated risk. Extending maturity beyond five years typically adds volatility without proportional return enhancement. The additional duration risk rarely justifies the marginal yield pickup.

High-yield (junk) bonds represent another problematic category. These securities carry substantial credit risk—the possibility that issuers will default—but historically haven’t provided adequate compensation for it. More problematically, high-yield bonds tend to decline sharply during equity market stress, exactly when diversification benefits are most valuable. Bonds rated below investment grade (typically BBB- or lower) exhibit this pattern. Instead of providing portfolio stability, they amplify losses during downturns.

Investment-grade bonds, particularly those rated AA or higher, offer a more favourable risk-return profile. These securities provide meaningful diversification benefits while maintaining acceptable credit quality.

The Diversification Solution

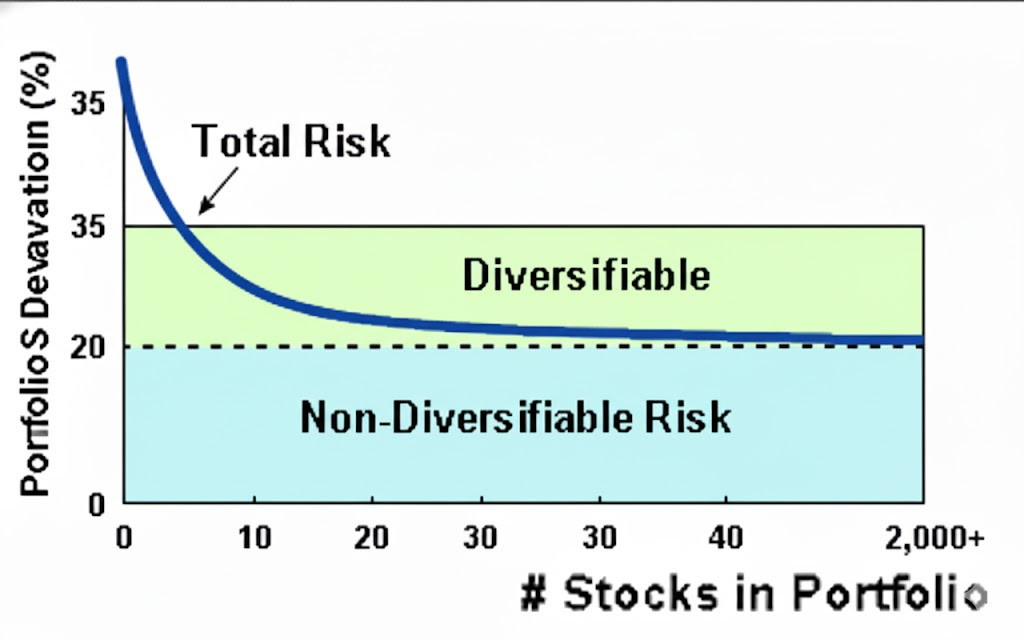

Market exposure rewards investors for bearing systematic risk—the risk of holding the entire market. Individual security selection and sector concentration, by contrast, introduce idiosyncratic risks that typically go unrewarded.

Building a diversified portfolio once required significant effort and ongoing management. Modern investment vehicles have greatly simplified this. A low-cost global equity index fund (such as one tracking MSCI All-Country World) combined with a global bond fund provides comprehensive diversification with minimal complexity.

ETFs (exchange traded funds, a kind of passive investments) offer an efficient way to implement this approach, allowing investors to hold thousands of securities through a single transaction.

Active Management Considerations

I previously touched on active management and will explore this topic more thoroughly in future posts. The essential point: genuinely skilled active managers exist, but they’re rare and difficult to identify in advance.

Without a firm conviction that you’ve identified exceptional management skill, low-cost index funds represent the more prudent choice. The evidence suggests that most investors achieve better outcomes through passive strategies than through active selection.

Often-Overlooked Risks

Counterparty risk refers to the possibility that an intermediary holding your assets fails. In regulated markets with established mutual fund structures, legal protections, and asset segregation requirements, this risk is substantially mitigated. Funds hold securities separately from their own assets, providing investor protection even in bankruptcy scenarios.

Inflation risk deserves particular attention and will be a recurring focus on this blog.

Short-term inflation proves nearly impossible to predict with useful accuracy. Long-term inflation protection, however, can be addressed through asset allocation. Real assets—particularly gold—serve this function effectively.

Gold generates no cash flows, but historically preserves purchasing power across long periods, especially during currency debasement or when real interest rates turn negative. Central banks maintain substantial gold reserves for precisely this reason: it provides inflation insurance that paper assets cannot.

Key Principles

Balance risk and safety through appropriate allocation between risky and risk-free assets

Accept only compensated risks and avoid taking on volatility that doesn’t enhance expected returns

Maintain broad diversification through global equity and bond exposure

Approach active management skeptically unless you have high confidence in manager selection

Address inflation risk, particularly for long-term financial goals

These principles are straightforward in concept. Consistent application, however, distinguishes successful long-term investors from those who chase performance or react to market volatility.

Effective investing isn’t about finding clever strategies. It’s about implementing sound principles with discipline.

[Updated: 2024.11.09]

Disclaimer

The views and opinions expressed on this website are for educational and informational purposes only, and should not be considered as investment advice. The author may hold positions in the stocks mentioned on this website. The author of this website is not a licensed stockbroker or financial advisor. Nothing contained herein should be construed as a recommendation to buy, hold, or sell any securities or financial products. Always seek the advice of a financial advisor and do your own independent research before making any trade or investment decisions.

We do not guarantee the accuracy or completeness of any information on this website. Such information is provided “as is” without warranty or condition of any kind, either express or implied. Past performance may not be indicative of future results. This website could include inaccuracies or typographical errors.

We are not liable or responsible for any damages incurred whatsoever from actions taken from information provided on this website, including financial losses. Since all readers who access any information on this website are doing so voluntarily and of their own accord, any outcome of such access is understood to be their sole responsibility. In no event shall we be liable to any person for any decision made or action taken in reliance upon the information provided herein.