This is a review of Tim Hale’s book ‘Smarter Investing’. All investment strategies, principles, and recommendations discussed are those presented in the book and reflect the author’s views, not my personal advice.

Tim Hale’s Smarter Investing is a practical guide for anyone seeking to build wealth without getting lost in financial jargon, products, or hype. Instead of offering secret strategies or tips, Hale provides something more valuable: a clear framework for making sound investment decisions aligned with real-life goals.

The Central Message

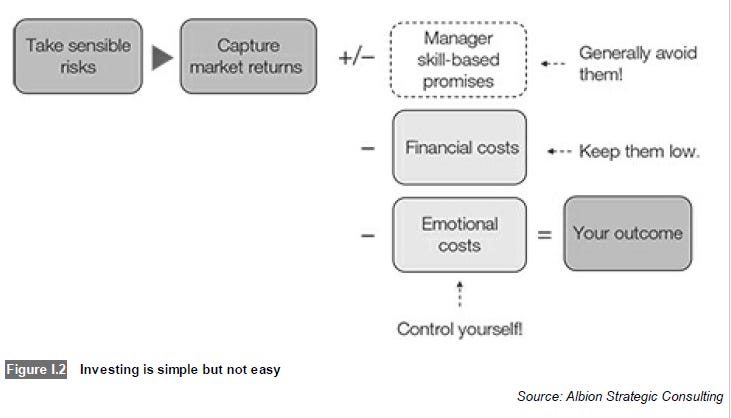

The book’s key message is simple: most investors fail by overcomplicating and letting emotions take over, not by lacking intelligence. As Hale says,

“Investing isn’t about beating others. It’s about controlling yourself.”

According to Hale, success comes from discipline, diversification, low costs, and matching investments to your risk tolerance - not from trying to predict market movements or chase star fund managers.

Understanding the Investing Landscape

Hale clears the confusion many investors face. He calls the modern financial industry a “battleground for investors’ money,” where marketing fuels fear and greed, and complex terms obscure more than clarify.

He strips investing to its core: using your savings for life goals, not gambling on trends. His core smart investing principles are:

Costs matter more than forecasts.

Diversification is essentially a free benefit.

Risk and return are inseparable.

Markets work better than most people think.

Simplicity beats sophistication.

One major insight Hale presents challenges a myth: you don’t need to “time the market.” Instead, he advocates focusing on “time in the market” - patience and consistency build long-term wealth.

The Psychology of Investing

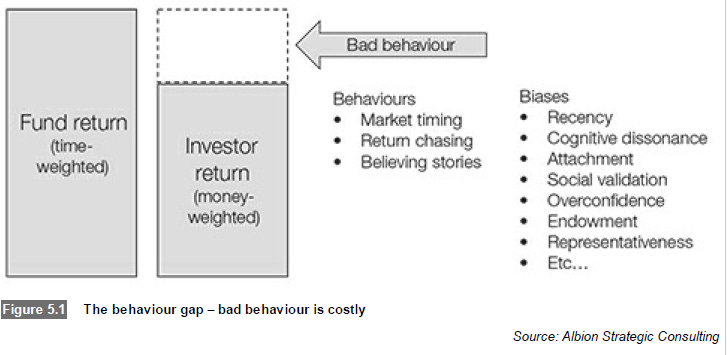

The book’s most valuable section addresses mental traps that cause self-sabotage. Many, Hale observes, “invest without a clear philosophy,” chasing trends and advice.

He presents compelling evidence against the search for the next star fund manager. While some outperform temporarily, almost none do so consistently. These managers can’t be reliably identified in advance. “You don’t need to play a game rigged in favor of the house,” he writes.

More importantly, Hale confronts psychology directly. “You are your own worst enemy,” he warns, explaining how biases like loss aversion, overconfidence, and herd behavior make us buy high and sell low. Research shows investors’ returns lag behind the funds they choose because they chase performance at the wrong times.

The solution Hale proposes? Automate investments, commit to a plan, and ignore market noise. The real obstacle isn’t knowledge - it’s emotion.

Building a Practical Portfolio

When discussing portfolio construction, Hale reframes risk: it’s not volatility, but the chance of missing your objectives. This shift keeps investors focused on what matters.

Hale’s approach to building what he calls the “Return Engine” is straightforward:

Start with a clear goal - retirement, education, or financial independence.

Choose appropriate asset classes - equities for growth, bonds for stability.

Diversify globally across regions, industries, and company sizes.

Minimize costs through index funds or ETFs.

Rebalance periodically to maintain your target allocation.

As Hale notes,

“You can’t eliminate risk, but you choose the risks you are rewarded for.”

The key takeaway he presents is to focus on building a portfolio that can withstand many possible outcomes, rather than seeking a perfect mix to predict the future.

He uses architecture as a metaphor: the best portfolio is like a well-designed building - built to withstand storms, not predict the weather.

Why This Matters for Regular Investors

Smarter Investing works by providing clarity, not complexity. It empowers readers by being clear and simple. Here’s why it succeeds:

It demystifies markets. You learn markets aren’t casinos but mechanisms that reward discipline and patience.

It acknowledges human nature. By highlighting psychology, Hale helps readers recognize common emotions.

It focuses on what you control. Asset allocation and behavior drive returns more than timing or fund-picking.

It’s evidence-based yet accessible. Hale uses academic research but explains it in plain, jargon-free language.

The Core Philosophy

Hale’s wisdom is simple: Plan first, know your goals, structure with broad, low-cost funds, and stay the course.

As he says, “Investing is simple, but not easy—because simple is doing less, not more.” Most importantly: “You win not by predicting, but by preparing for the future.”

This is fundamentally a book about self-control disguised as a book about finance.

The Bottom Line

Smarter Investing teaches you how to think about money, not what specific products to buy. It’s the perfect antidote to the hype-driven culture of financial media and the anxiety it creates.

The book’s greatest achievement is psychological: it lets readers stop guessing and start planning. The smartest investors aren’t the best forecasters - they’re the ones with the most discipline.

Hale argues that if you control costs, emotions, and expectations, the market will do the heavy lifting. That’s not a promise of easy riches, but a real path to lasting wealth through patience and clear thinking.

In a world urging investors to do more, Hale’s message stands out: Do less, think clearly, stay the course, and let time and discipline work.

Disclaimer

The views and opinions expressed on this website are for educational and informational purposes only, and should not be considered as investment advice. The author may hold positions in the stocks mentioned on this website. The author of this website is not a licensed stockbroker or financial advisor. Nothing contained herein should be construed as a recommendation to buy, hold, or sell any securities or financial products. Always seek the advice of a financial advisor and do your own independent research before making any trade or investment decisions.

We do not guarantee the accuracy or completeness of any information on this website. Such information is provided “as is” without warranty or condition of any kind, either express or implied. Past performance may not be indicative of future results. This website could include inaccuracies or typographical errors.

We are not liable or responsible for any damages incurred whatsoever from actions taken from information provided on this website, including financial losses. Since all readers who access any information on this website are doing so voluntarily and of their own accord, any outcome of such access is understood to be their sole responsibility. In no event shall we be liable to any person for any decision made or action taken in reliance upon the information provided herein.

As you can expect from Attila this review is short, focused, intelligent and provides you enough information to decide if you want to read this book or not.