This is a review of Sébastien Page’s book ‘Beyond Diversification’. All investment strategies, principles, and recommendations discussed are those presented in the book and reflect the author’s views, not my personal advice.

Sébastien Page’s Beyond Diversification is a practical and thoughtful guide to one of the most important topics in personal finance: building a portfolio that withstands real-world market conditions. While diversification remains essential, Page shows that the traditional “just diversify” advice is no longer enough in an environment where markets move together in times of stress. Instead, he offers a more comprehensive approach to risk, correlations, asset allocation, and long-term portfolio design.

For laypeople, the book works because it strips away jargon and focuses on the principles that genuinely matter. Page’s goal isn’t to forecast the future or give specific investment recommendations, but to help readers understand how different asset types behave and how combining them thoughtfully can improve long-term outcomes.

Why “Beyond Diversification”?

Most investors learn early on that diversifying - holding different asset classes - helps reduce risk. Page agrees, but he also warns that in stressful periods, this approach often disappoints. Correlations can spike, meaning assets that normally move in different directions suddenly move together.

He points out that investors must “look beyond diversification to manage portfolio risk” and use better tools to understand how assets behave in difficult markets:

“Investors should look beyond diversification… tail-risk hedging, defensive momentum strategies, and dynamic risk-based strategies all provide better left-tail protection than traditional diversification.”

A key theme is that diversification works on average, but what matters most to real people is how their portfolio behaves when it hurts. That’s when correlations matter most, and traditional models often fail.

Understanding Risk More Realistically

One of the book’s most practical contributions is its emphasis on analysing tail risk: rare but painful losses that disproportionately shape long-term results.

Page encourages readers to avoid blindly trusting historical correlations. Instead, he recommends scenario analysis and tools that highlight how assets behave during market downturns:

“Don’t blindly rely on full-sample correlations… use portfolio optimization tools that account directly for left-tail risks.”

For beginners, this means broad diversification remains valuable, but awareness of how assets behave under stress is equally important. Some assets that appear stable - especially private investments - may simply have infrequent pricing rather than genuinely low risk:

“Private assets’ diversification advantage is almost entirely illusory… their left-tail exposures are much higher.”

This is a gentle but important warning: if something looks too stable, it may simply be under-measured rather than safe.

Asset Allocation as the Engine of Investment Outcomes

A central message throughout the book is that asset allocation - the mix of stocks, bonds, cash, and alternatives - is the main driver of long-term results. Page emphasises that this decision affects outcomes more than almost anything else:

“Asset allocation is simply about seeking the highest possible return given our risk tolerance.”

This theme is especially helpful for non-experts. Instead of focusing on stock-picking or forecasts, understanding how much risk one can handle and choosing a sensible mix helps create a more stable financial life.

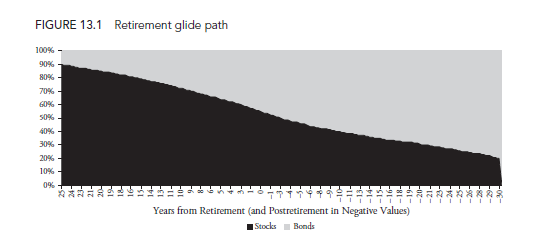

Target-date funds, which automatically adjust stock-bond mixes over time, are highlighted as an example of simple, effective asset allocation for everyday savers. Page presents them as “autopilot solutions” that offer diversified exposure while adapting to an investor’s lifecycle.

The Value of Evidence-Based Decisions

Throughout the book, Page is careful not to present any “holy grail.” Instead, he stresses that combining simple models, historical data, and broad reasoning often leads to better decisions than following market stories or relying purely on intuition:

“The question is not whether a model is flawless… The question is whether the model helps investors arrive at better decisions.”

This focus on decision quality makes the book especially relevant for beginner investors. You don’t need to predict the future or master complex mathematics. You only need a framework that helps you avoid large, unnecessary mistakes.

The Role of Active vs Passive Investing

Unlike books that take a dogmatic position, Page adopts a balanced approach. He argues that both passive and active investing have roles, and markets benefit from the coexistence of both:

“Passive investors and stock pickers can happily coexist… Market efficiency remains a paradox.”

For beginners, this means you don’t need to choose sides. A reasonable portfolio can include low-cost index funds and, if desired, a measured allocation to certain strategies that aim for active returns. What matters is that each choice fits your risk tolerance and long-term plan.

When Diversification Fails

Page repeatedly warns that diversification isn’t a guarantee. Stock-bond correlations sometimes turn positive; private assets may be riskier than they appear; and in major sell-offs, almost everything can move together:

“Investors should be aware that traditional measures of diversification may belie exposure to loss in times of stress.”

Rather than discouraging diversification, this insight encourages a more realistic and prepared mindset. For example, strategies such as managed volatility - which reduces stock exposure when volatility spikes - may provide smoother long-term results without abandoning growth.

Practical Lessons for Everyday Investors

Although the book is geared toward professionals, several lessons translate well for laypeople:

Have a clear stock-bond mix. This is the most important starting point and influences long-term outcomes more than any single trade.

Diversification matters - but only if you understand its limits. Diversify across asset classes, but remember that correlations can change during stress.

Don’t chase exotic assets based on low volatility claims. Some alternatives look safer than they truly are due to infrequent pricing.

Use simple, rules-based elements where possible. Managed volatility, periodic rebalancing, and scenario thinking help manage risk without forecasting.

Think in terms of long-term probabilities, not short-term predictions. This aligns with the book’s overall evidence-based approach.

Conclusion

Beyond Diversification is a clear, practical, and well-reasoned guide to modern portfolio construction. Its core message is simple: traditional diversification is helpful, but not sufficient. Understanding correlations, tail risks, and long-term behaviour of asset classes allows investors to build more resilient portfolios.

For everyday investors, the book offers confidence that good investing doesn’t require prediction or sophisticated trading. Instead, it requires a sensible asset mix, realistic expectations, and a clear understanding of risk.

By combining evidence, common sense, and accessible explanations, Page provides readers with a framework that is both robust and adaptable - qualities that matter more than ever in a complex, interconnected financial world.

If you enjoyed this, explore more articles and ideas on my blog here.

Disclaimer

The views and opinions expressed on this website are for educational and informational purposes only, and should not be considered as investment advice. The author may hold positions in the stocks mentioned on this website. The author of this website is not a licensed stockbroker or financial advisor. Nothing contained herein should be construed as a recommendation to buy, hold, or sell any securities or financial products. Always seek the advice of a financial advisor and do your own independent research before making any trade or investment decisions.

We do not guarantee the accuracy or completeness of any information on this website. Such information is provided “as is” without warranty or condition of any kind, either express or implied. Past performance may not be indicative of future results. This website could include inaccuracies or typographical errors.

We are not liable or responsible for any damages incurred whatsoever from actions taken from information provided on this website, including financial losses. Since all readers who access any information on this website are doing so voluntarily and of their own accord, any outcome of such access is understood to be their sole responsibility. In no event shall we be liable to any person for any decision made or action taken in reliance upon the information provided herein.